Imagine a place where managing your money feels straightforward, where you can easily find ways to grow what you have, and where getting access to your funds is never a problem. This is, in a way, what Rexas Finance aims to bring to the table for everyone. It’s about opening up possibilities for your money, making it simpler to get to what you own and find new ways to put it to work for you.

You see, the way we handle money is changing, and Rexas Finance wants to be right there with you, offering a different approach to how assets are managed. They are building a system where the flow of your money and the chances you get to invest are really quite open. It's about making sure that your assets can be used when you need them, and that there are plenty of avenues for you to explore when you want to make your money do more.

This approach covers a lot of ground, from keeping an eye on the latest values of digital currencies to helping you with big life steps, like finding the right home loan. It’s all about creating a smoother experience for people who are looking for a reliable way to manage their finances, whether they are just starting out or have been investing for some time. So, it's almost like a helpful guide for your financial path.

Table of Contents

- What Does Rexas Finance Offer You?

- How Does Rexas Finance Connect You to the Digital Economy?

- Is Rexas Finance Building a Stronger Financial Future?

- Can Rexas Finance Help with Your Home Loan in Texas?

What Does Rexas Finance Offer You?

When you think about managing your money and investments, what comes to mind? For many, it can feel like a complicated process, full of jargon and tricky steps. But what if there was a way to make it all a little bit simpler, a bit more open? Rexas Finance, you see, presents itself as a way to step into what they call the coming times of asset management. It’s about getting a way to access a financial situation where your money can move freely and where there are many chances to put your funds into something new. This really is quite a different approach for many people.

A New Way to Handle Your Money with Rexas Finance

At its core, Rexas Finance is about giving you a way to handle your money in a fresh light. They talk about giving you access to a place where the movement of your assets and the chances for investment are truly without limits. This means that if you have something you own, like a piece of a digital asset, it can be easily turned into something else, or used in a new way, whenever you might need it. It’s about making sure your money isn't stuck, but can actually be used to its fullest potential. So, it’s almost like having a clear path for your funds.

They also provide information that helps you keep track of things. For example, the Rexas Finance (RXS) price index gives you the very latest value of RXS in US dollars, Bitcoin, and Ethereum. This information comes from an average of what are considered the top digital currency trading places around the globe. This kind of immediate insight is, you know, quite useful for anyone wanting to stay updated on their digital holdings. It helps you see where things stand at any given moment, which is pretty much what most people want when dealing with their money.

- Fmottrn Nude

- Celebrity Nip Slips

- Dad Jokes Funny

- Ruoff Home Mortgage Music Center Noblesville

- Fursuit Sex

Making Assets Flow More Easily with Rexas Finance

One of the big ideas behind Rexas Finance is making sure your assets can move easily. This means they've built their system so that it naturally helps things flow better. They also aim to make it possible for you to own just a piece of an asset, rather than needing to buy the whole thing. This idea of owning a fraction of something, like a part of a building or a share in a larger investment, opens up possibilities for many more people to get involved. It means you don't need a huge amount of money to start participating, which is, honestly, a pretty neat concept for accessibility.

They talk about this system helping with the flow of money by its very make-up. It's about designing a way for assets to be more readily available and more easily exchanged. This, in turn, helps to make markets more active and more fair for everyone involved. For instance, if you own a small portion of a larger asset, you can still participate in its value changes without having to commit to the entire item. This is, you know, a way to make bigger investments more approachable for a lot of people.

How Does Rexas Finance Connect You to the Digital Economy?

The digital world is always changing, and with it, the ways we can use our money. Rexas Finance looks to be a part of this change by offering a set of tools that help you work within this newer, more connected financial space. It's about giving people what they need to interact with what’s often called Web3 and DeFi, which are just ways of talking about the next generation of online money systems. So, they’re providing the bits and pieces that help you make sense of this new financial structure.

The Tools Within the Rexas Finance World

The Rexas Finance setup includes various tools that are meant to help you operate in the digital currency space. For instance, they have features for swapping one digital token for another, which is a common activity for anyone dealing with these kinds of assets. They also offer what they call a Rexas token builder. This tool lets you create your own new digital tokens, which could be useful for businesses or even just for personal projects. It’s, like, a way to bring new digital assets into being.

Beyond creating tokens, there's also a Rexas launchpad. This is a place where new digital currency projects can get the funding they need to start. Think of it like a platform where ideas can find support from people who want to invest in them. This helps new projects get off the ground and gives investors a chance to be part of something from its early stages. All these tools together form what they call the Rexas Finance system, which is, you know, pretty comprehensive for digital asset dealings.

Opening Doors to New Investment Paths Through Rexas Finance

Rexas Finance also looks at bigger investment opportunities, especially in areas like real estate. They offer a marketplace for real estate, alongside their token builder and launchpad. This is all put in place to help both investors and those who issue assets get into the future of tokenized fund assets, which is a market that could be worth a very large sum of money, something like $600 billion. This means they are trying to bridge the gap between traditional assets, like property, and the newer digital ways of owning things. It’s, basically, about making big investments more reachable.

The idea of tokenized fund assets is that you can own a piece of something valuable, like a building, through a digital token. This makes it easier to buy and sell parts of these assets, rather than having to deal with all the paperwork and processes of traditional ownership. Rexas Finance wants to be a key player in this kind of future, providing the means for people to access these opportunities. They are, you know, working to make these kinds of investments more straightforward for a wider group of people.

Is Rexas Finance Building a Stronger Financial Future?

When you consider how quickly the financial world is changing, it's natural to wonder if new services are truly making things better for everyone. Rexas Finance seems to be positioning itself to make a real impact for people around the world who are looking to invest. They suggest that by making it easier to get into markets, by making assets more available, and by making everything more visible, they are in a good spot to help investors globally. This, you know, could be quite beneficial for many individuals.

Reaching More People with Rexas Finance

Rexas Finance states that they have changed the usual way of doing things for many people who were looking for financial services that they could count on and that felt safe. This means they’ve tried to provide a different kind of experience, one that helps people feel more secure about where their money is and how it’s being handled. They encourage people to find out about the current guidelines, what you need to do, and how you can get started with them today. This kind of open invitation is, actually, pretty welcoming.

With better ways to get into markets, more readily available funds, and a clearer view of what’s happening, Rexas Finance is now in a good place to bring in investors from all over the globe. This indicates that their efforts to make things more open and accessible are starting to show results, attracting a broader group of people who want to put their money to work. It’s, sort of, like building a bridge for money to flow more freely across different places and people.

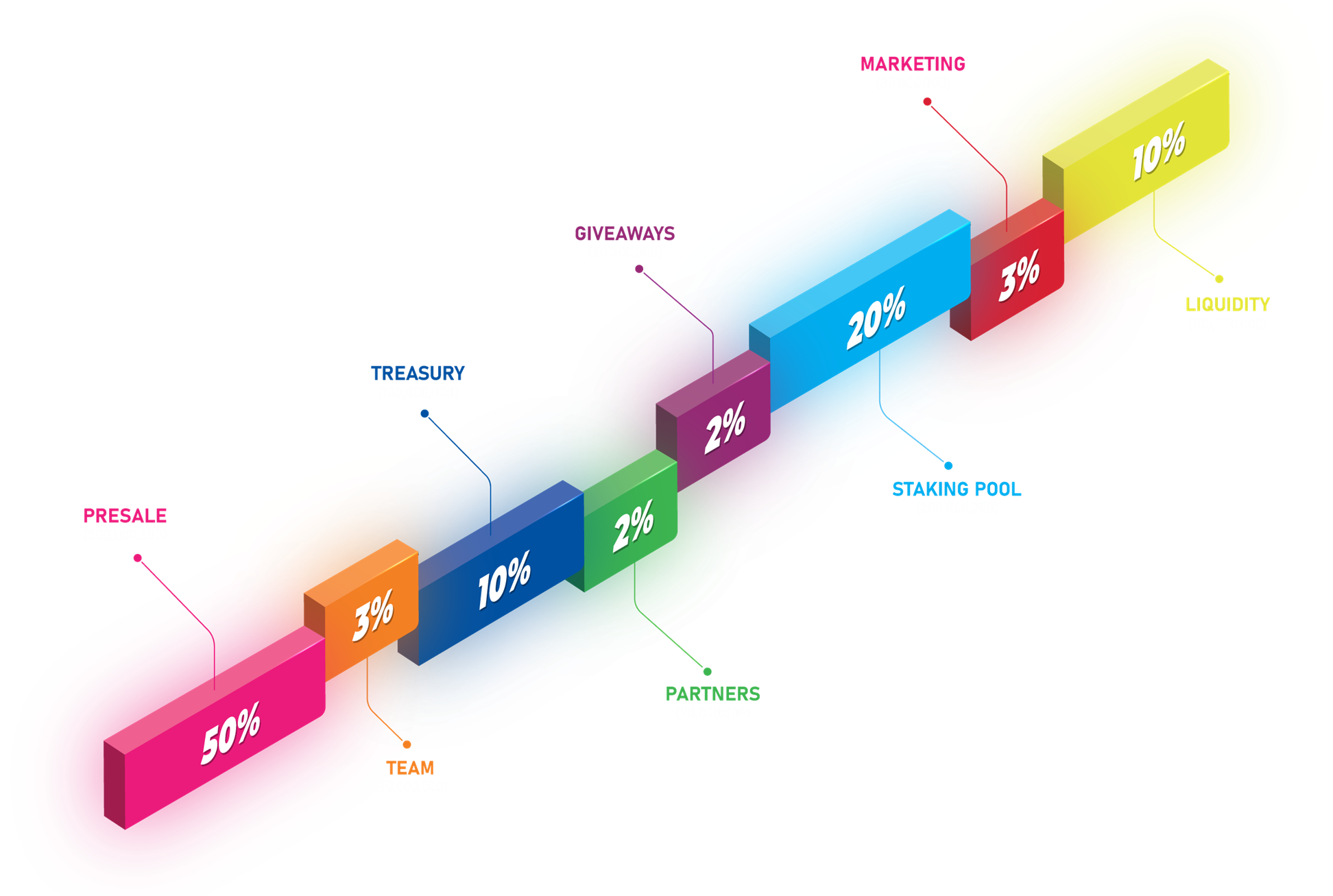

Recent happenings also show some interesting trends for Rexas Finance. For example, the final day of their presale period was met with a lot of positive energy in the digital currency community. Following this, Rexas Finance (RXS) saw a significant jump in value, going up over 300% after being listed on major trading platforms like LBank, BitMart, and MEXC. These kinds of events, you know, often spark discussions about where the price might go next, like whether RXS will reach a certain value soon. There are analyses that try to guess these future movements.

Can Rexas Finance Help with Your Home Loan in Texas?

It might seem like a big jump from digital assets to home loans, but Rexas Finance also touches on services that are very much about everyday life, especially for those in Texas. If you're looking for rates on home loans in Texas, or if you're thinking about changing your current home loan to a better one, they point to resources that can help. This includes looking at loan interest rates from local banks, credit unions, and brokers in Texas, often found through services like Bankrate.com. So, it’s not just about digital money, which is, you know, a bit surprising but helpful.

Finding Home Loan Rates and Refinance Options with Rexas Finance

Texas has its own particular guidelines when it comes to changing home loans. Current patterns show that interest rates in Texas have been moving up and down, which means that picking the right time to make a change can be quite important if you want to save the most money. Staying informed about the very latest trends for RXS, for instance, is something they suggest. This information can help you make a more informed choice about when to act. It's, basically, about being smart with your timing.

They also suggest comparing different options for changing your home loan from various lenders in Texas. You can get free, personalized quotes for your area to help you find the lowest rates that are currently available. If you're looking for the very best rates on home loans or refinancing in Texas, you can save money by comparing free, personalized quotes from services like NerdWallet. They will show you both current and past rates, which is, you know, quite useful for making a good choice. This really helps to simplify a sometimes complex process.

If you are considering changing your home loan in Texas, you can do so with what they describe as low rates, quick approval, and help from experts. Getting started with the Texas mortgage professionals today is what they suggest. This highlights a more traditional financial service that Rexas Finance mentions, showing a broader scope than just digital currencies. It shows that they are, in a way, looking to assist with various aspects of personal finance, making it easier for people to get the support they need for big decisions like home ownership.

Related Resources:

Detail Author:

- Name : Piper O'Reilly

- Username : brennon78

- Email : preston.brakus@hotmail.com

- Birthdate : 1979-12-26

- Address : 28878 Yundt Overpass Lake Fosterville, NJ 66511-1429

- Phone : +1.443.444.6992

- Company : Klein-Borer

- Job : Computer Support Specialist

- Bio : Ut impedit est facilis quasi dolor et. Et maxime qui itaque voluptatem est.

Socials

tiktok:

- url : https://tiktok.com/@fishere

- username : fishere

- bio : Sint distinctio molestiae reprehenderit. In est officia et molestias.

- followers : 5359

- following : 1486

twitter:

- url : https://twitter.com/erich_xx

- username : erich_xx

- bio : Assumenda officia facere distinctio mollitia recusandae. Mollitia ut architecto id. Nihil tempora aut enim sint numquam vel. Quo magnam quo maxime vitae.

- followers : 4147

- following : 203

linkedin:

- url : https://linkedin.com/in/efisher

- username : efisher

- bio : Quod architecto aut voluptates.

- followers : 3672

- following : 1844